IT Due Diligence

Why Due Diligence?

- Technology is a key driver for M&A.

- With the advent of e-currencies, e-payments, online services for customer acquisition and contact, Banks and Insurance companies look more like a technology company than ever before.

- IT is complex in banks and insurance because they deal with complex financial instruments as well as a lot of legal and statutory regulations. Businesses are structured around products and products are being offered to the customers via portals and in the background run complex interactions between different systems. Pure IT or pure finance resources are not able to understand and evaluate individually. Our experts navigate both these worlds seamlessly.

- Customers are very sensitive to the operation interruptions which are totally dependent upon many systems working together. Seamless transition from day 1, with no change in the facilities offered to the customers and other partners is expected.

- Our IT Due Diligence integrated with digital and functional aspects makes this transition seamless. In this sense, our offer is different from the other traditional technology Due Diligence offered in the market.

- We have experience and expertise in financial industry-specific processes and therefore can offer specialized IT Due Diligences for banks and insurance companies.

The Transactions team at PwC can support you in finding the best answers to any question you may face. With a team of more than 100 transactions experts our expertise spans all industries, sectors and technologies. We listen to you to make sure we understand your organisation’s structure, its products and services, and the transactions you’re planning. As M&A specialists and valued advisors for legal matters, we provide a customised service tailored to your goals.

By working together with you and your team, we’re always ready for the next step in the transaction process. We take advantage of the latest comprehensive data and analytics technologies. This supports a fast evaluation of your data and also creates transparency by providing real-time data visualisation.

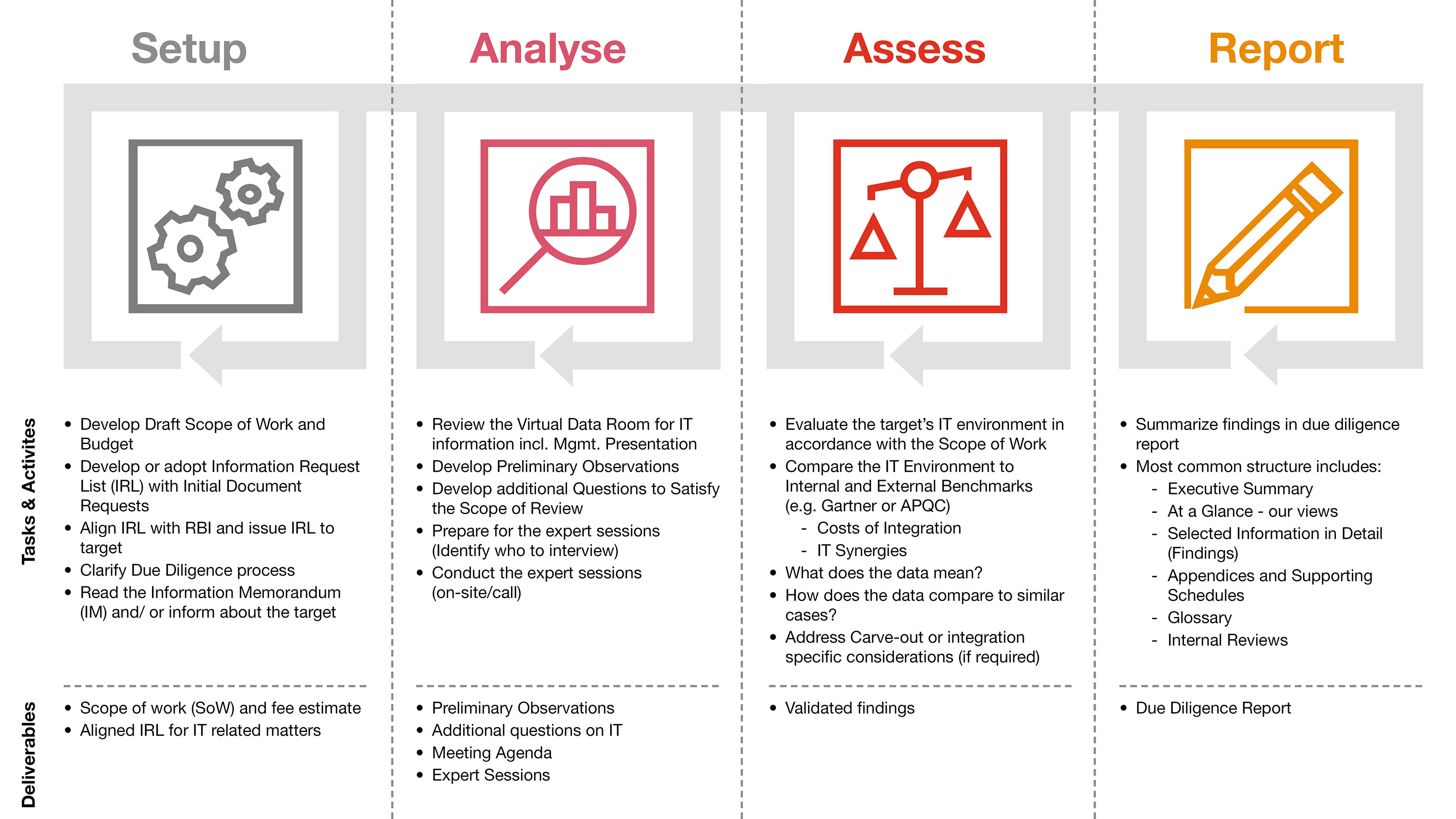

Our IT Due Diligence Approach

We deliver a typical IT Due Diligence project in four phases.

Pre-Closing

IT Architecture, Core Banking, CRM, ERP, Regulatory Reporting, Data & Analytics

- Ensure Day 1 readiness and business continuity (enabling cross- company interfaces and accesses), including financial, management and regulatory reporting

- Develop IT Enterprise Architecture Blueprint, for both core banking and satellites

- Process design and adjustments implementation

- Prepare data migration rules and initiate data structure mapping and cleansing

Network, Data Center / Cloud, Workplace, Branches, ATM

- Infrastructure Day 1 separation / integration incl. cutover, network segmentation / integration and user access including adoption of firewalls

- Follow-up on short / mid term value levers, integration / separation issues from DD

- Define Day 1 considerations for data center, hosting segmentation, integration, workplace computing, asset transfer, assets in the branches and ATMs

IT Security, Data Privacy & Security, Identity & Access Management

- Day 1 IT security enabled

- Implement cyber security risk mitigation roadmap to achieve defined level of maturity

- Implement data privacy risk mitigation roadmap, data privacy & security compliance, I&A management risks

TSA, Contracts, Licenses

- Define / negotiate final TSA (description, duration, costs, governance, monitoring)

- Define separation / transfer approach and agree / inform respective vendors

- Day 1 IT vendor management (incl. selection)

- IT license separation / integration strategy and reconciliation in order to achieve Day 1 license compliance

IT Organisation, IT Governance & Policies, IT Processes, Organisational Change Management

- Organization structure and HR alignment

- Definition & implementation of Day 1 IT organization, IT processes and IT governance (incl. bodies, key IT policies)

- Prepare stakeholder analysis and derive org. change impact (change and communication plan for IT leaders and staff)

Post-Closing

IT, Core Banking, CRM, ERP, Reporting, Data & Analytics

- Post Day 1 hypercare and stabilization

- Business process optimization & automation

- Design the to-be application landscape, with focus on consolidation, decommissioning and synergies of applications between the two companies

Network and Data Center, Workplace, Branches, and ATM

- Long-term optimization of the infrastructure architecture (e.g. data center consolidation)

- Rightsizing / integration of network services considering business requirements

- Rightsizing / consolidation infrastructure services e.g. data center consolidation, cloud migration and associated disaster recovery concepts

Continuous IT Security, Privacy & Security, Identity & Access Solutions

- Long-term optimization of the Cyber Security architecture

- Enablement of data privacy organisation

- Identification and implementation of long-term data privacy activities (GDPR)

- Define and implement I&A requirements for integrated / standalone setup

- User awareness trainings

Contracts, Licenses, and TSA

- Cost improvement & rightsizing IT sourcing strategy and software licenses

- IT contracts consolidation / renegotiation

- TSA monitoring and exit management

- Implement optimized vendor management and technical & organizational IT & software asset management optimization measures

IT Processes, Organisation, Governance & Policies, and Organisational Change Management

- IT organization optimization, redesign, rightsizing and integration

- Guidelines & governing bodies optimization

- Synergy realization, re-adjust IT project portfolio

- Re-design and automate IT Process landscape incl. adjustments of IT4IT tools, e.g. ITSM, PPM,, CMDB, …